Note:

The Certified Bookkeeper sequence of courses is being taught by me independent of any schools/universities. The American Institute of Professional Bookkeepers has the final authority on issuing the qualifying certificates and Certified Bookkeeper designation. As such, my role will be to mentor students through the six courses that are required as part of the Certified Bookkeeper certification program. In addition to these six courses, the American Institute of Professional Bookkeepers also requires an examination for each course, as well as documented work experience in the bookkeeping/accounting profession. Click here for a video with more information on the experience requirement.

.

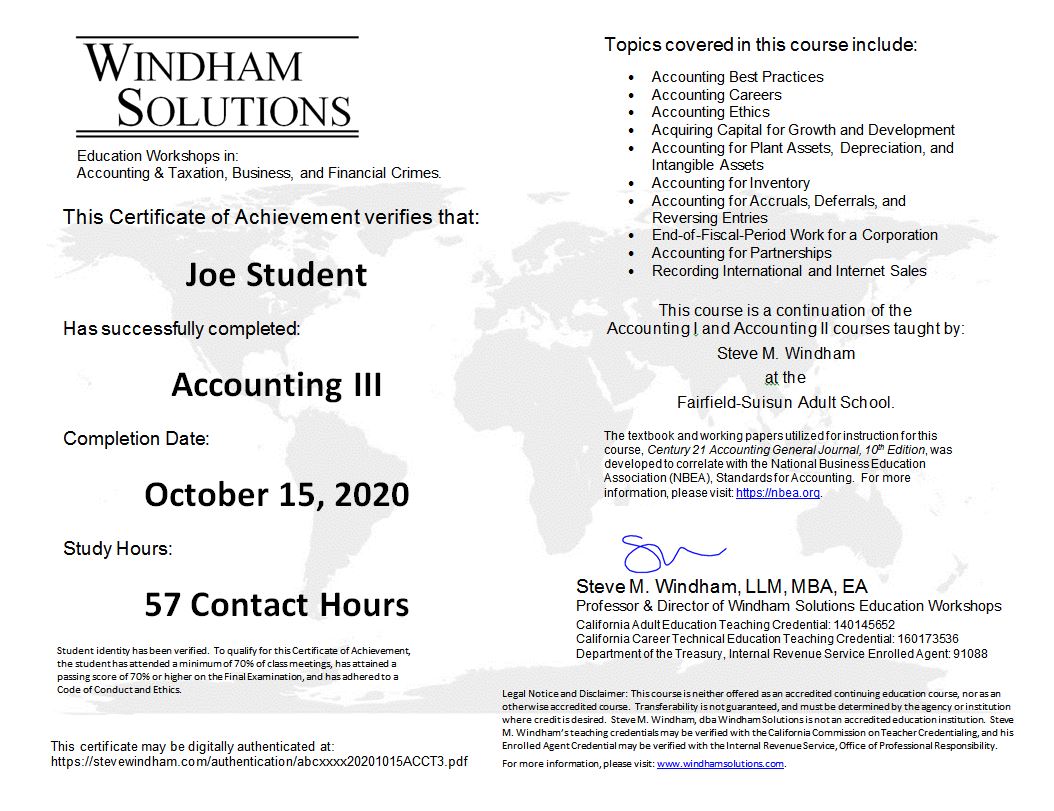

Upon successful completion, I will award a digital Certificate of Achievement (click here or see below) that will confirm and document your study time on each course; however, these certificates are not recognized by the American Institute of Professional Bookkeepers. To receive official credit for the course, the student must successfully complete the American Institute of Professional Bookkeepers examination, either at the end of the textbook (for two of the courses), or at a Prometric Testing Center (for the other four of the courses).

.

.

.

.

Required Textbooks:

Textbooks for the Certified Bookkeeper sequence of courses may be purchased as a set or individually. They are also offered in softcover format, as well as online e-books.

.

.

Information on purchasing the complete softcover set can be found here.

Information on purchasing the complete online e-book set can be found here.

Information on purchasing the complete online e-book set can be found here.

Information on purchasing the books (both softcover and online e-books) individually can be found here.

.

* I strongly recommend that you become a member of the American Institute of Professional Bookkeepers for many reasons, including a discount on their books.

.

Fees:

My fees for mentoring the classes are as follows:

--Mastering Adjusting Entries ($50.00)

--Mastering Correction of Accounting Errors ($50.00)

--Mastering Payroll ($50.00)

--Mastering Inventory ($50.00)

--Mastering Depreciation ($50.00)

--Mastering Internal Controls and Fraud Prevention ($25.00)

*Note that these fees do not include the textbooks, membership in the American Institute of Professional Bookkeepers, or Prometric testing fees.

.

Course Schedule:

I will be mentoring the "Mastering Internal Controls and Fraud Prevention" course first. The targeted start date is in October/November of 2021. This course should take about one month to complete, meeting one evening per week.

.

The second course I will be mentoring is the "Mastering Inventory" course. This course will be significantly longer, and will start sometime around January 2022. This course should take about 2-3 months to complete, meeting one evening per week.

.

Course Delivery Method:

I will mentor these courses online via Zoom. As such, all students must have a webcam-equipped computer with Internet access.

Upon successful completion of this course, students will be awarded a digital Certificate of Achievement like the one below. This Certificate of Achievement can also be digitally verified via the URL at the bottom of the certificate.

.

To qualify for this Certificate of Achievement, the student must have attended a minimum of 70% of class meetings and must adhere to a Code of Conduct and Ethics.