Social Security can be a tricky topic, and many people have many misunderstandings on how it actually works. When considering how to maximize Social Security Survivor Benefits for a spouse, there are several factors that must be taken into consideration. Kiplinger has a great article that explains in detail what you need to know if you need to maximize Social Security Survivor Benefits.

Click here to link to the article.

Category: Social Security

Fill Your Days!

Fill Your Days! This is my advice to people. I have been saying it for quite some time.

Nobody knows how long they are going to live, but yet, so many people waste time... not just moments of time, but sometimes days, weeks, and even longer!

When you are on your deathbed, no amount of money will add any significant, quality of life, time to your life.

Carpe Diem! Seize the day! Quit procrastinating! Do something meaningful!

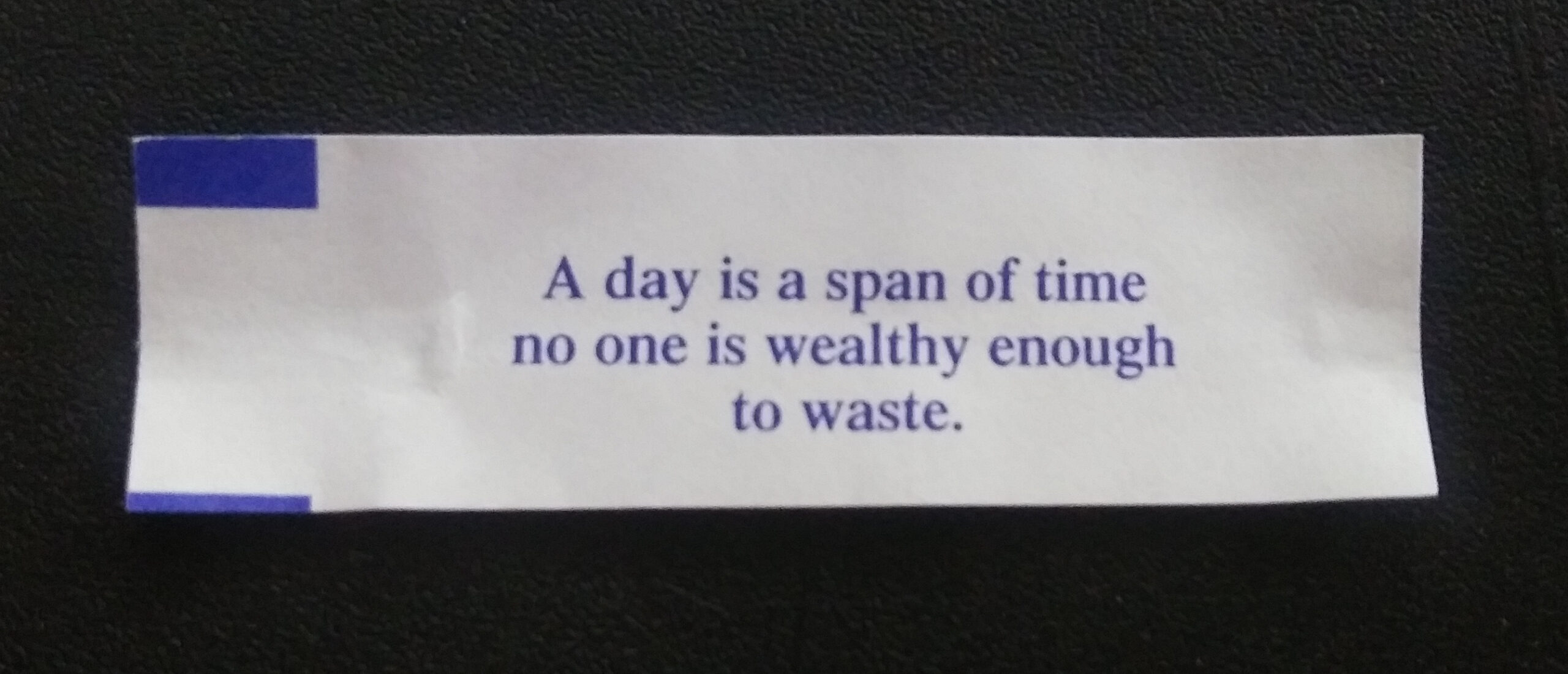

This weekend, this was in my fortune cookie:

While nobody knows just how long they are going to live, it is always interesting to check your life expectancy on the Social Security, Actuarial Life Table.

Carpe Diem, and fill your days, my friends!

“my Social Security” Account

With “my Social Security” you can set up an online account with the Social Security Administration to handle several tasks online. According to the Social Security Administration website, your “my Social Security” account can be used for the following:

If you do not receive benefits, you can:

Request a replacement Social Security card if you meet certain requirements;

Request a replacement Social Security card if you meet certain requirements; Check the status of your application or appeal.

Check the status of your application or appeal.- Get your Social Security Statement, to review:

- Estimates of your future retirement, disability, and survivors benefits;

- Your earnings once a year to verify the amounts that we posted are correct; and

- The estimated Social Security and Medicare taxes you’ve paid.

- Get a benefit verification letter stating that:

- You never received Social Security benefits, Supplemental Security Income (SSI) or Medicare; or

- You received benefits in the past, but do not currently receive them. (The letter will include the date your benefits stopped and how much you received that year.); or

- You applied for benefits but haven’t received an answer yet.

If you receive benefits or have Medicare, you can:

Request a replacement Social Security card if you meet certain requirements;

Request a replacement Social Security card if you meet certain requirements;- Get your benefit verification letter;

- Check your benefit and payment information and your earnings record;

- Change your address and phone number;

- Start or change direct deposit of your benefit payment;

- Get a replacement Medicare card; and

- Get a replacement SSA-1099 or SSA-1042S for tax season.