Hello Everyone,

The Departmentalized Accounting class starts on Tuesday, October 18, 2022 at 6:00 PM. The end time will be at approximately 9:00 PM.

The Zoom information and URL to attend the class is:

Steve Windham is inviting you to a scheduled Zoom meeting.

Topic: Departmentalized Accounting

Time: Oct 18, 2022 06:00 PM Pacific Time (US and Canada)

Every week on Tue, 16 occurrence(s):

Oct 18, 2022 6:00 PM

Orientation.

(Contact Hours = 1.00 Hour. Students = ARM)

Oct 25, 2022 6:00 PM

Cancelled--Students waiting on books.

Nov 01, 2022 6:00 PM

Cancelled--Student sick.

Nov 08, 2022 6:00 PM

Cancelled--Student sick.

Nov 15, 2022 6:00 PM

Cancelled--Steve business trip.

Nov 22, 2022 6:00 PM

Reviewed Lesson 1-1 and 1-2, including: ETHICS IN ACTION--Page 6, FORENSIC ACCOUNTING--Page 10 (Excel File), and GLOBAL AWARENESS--Page 18; Working Papers pages 1, 2, 3, 5, & 6.

(Contact Hours = 3.00 Hours. Students = AR)

Nov 29, 2022 6:00 PM

Working Papers pages 7, 8, 9,10, 11, & 12. Reviewed Lesson 1-3, including: WHY ACCOUNTING--Page 20 and EXPLORE ACCOUNTING--Page 30.

(Contact Hours = 3.00 Hours. Students = ARM)

Dec 06, 2022 6:00 PM

Reviewed remainder of Lesson 1-3. Where's my missing dollar problem; Working Papers pages 13, 14, 15, 16, 17, & 18. Review next week's lesson.

(Contact Hours = 3.00 Hours. Students = ARM)

Dec 13, 2022 6:00 PM

Multiple people sick--class cancelled.

Dec 20, 2022 06:00 PM

Christmas break--no class.

Dec 27, 2022 6:00 PM

Textbook 1-1 Application Problem, Page 31 (Working Papers Page 19), Textbook 1-C Challenge Problem, Page 33 (Working Papers Page 31), Textbook Auditing for Errors, Page 35 (click here for spreadsheet).

(Contact Hours = 2.00 Hours. Students = ARM)

Jan 03, 2023 6:00 PM

Textbook, Pages 36-45. Discuss: Ethics in Action, Page 39 and Financial Literacy, Page 44. Working Papers -- Study Guide 2, Pages 43-45.

(Contact Hours = 3.00 Hours. Students = ARM)

Jan 10, 2023 6:00 PM

Class cancelled -- S sick.

Jan 17, 2023 6:00 PM

Textbook 2-1 Work Together, Page 46 (Working Papers Pages 47-49).

(Contact Hours = 2.00 Hours. Students = RM)

Jan 24, 2023 6:00 PM

Class cancelled -- R in Hawaii.

Jan 31, 2023 6:00 PM

Textbook, finish 2-2, including Chapter Summary, Page 57, Explore Accounting, Transfer Pricing, Page 57, and 21st Century Skills, Page 61.

Textbook 2-1 On Your Own, Page 46 (Working Papers, Pages 50-52).

(Contact Hours = 3.00 Hours. Students = ARM)

February 06, 2023 6:00 PM

Discuss prior week work.

(Contact Hours = 0.75 Hours. Students = ARM)

February 13, 2023 6:00 PM

No class.

February 20, 2023 6:00 PM

Rescheduled for February 21, 2023 6:00PM because Steve was travelling.

February 21, 2023 6:00 PM

Class cancelled -- one of the students was sick.

February 27, 2023 6:00 PM

Review 3-1 (Pages 64-65); Ethics in Action (Page 64); and Global Awareness (Page 65).

Short class due to tax season.

(Contact Hours = 1.00 Hours. Students = ARM)

March 06, 2023 6:00 PM

No class.

March 13, 2023 6:00 PM

Review 3-1 (Pages 66-73); Forensic Accounting (Page 72).

Crazy Eddie Videos on youtube.com.

Audit your understanding (Page 74).

Work Together 3-1, Page 74 (Pages 89-90 in Working Papers).

On Your Own 3-1, Page 74 (Pages 91-92 in Working Papers).

(Contact Hours = 3.00 Hours. Students = ARM)

March 20, 2023 6:00 PM

Review 3-2 (Pages 76-82).

Audit your understanding (Page 83).

Why Accounting? "Executive Compensation" (Page 82).

Audit your understanding (Page 82).

Work together 3-2, Page 83 (Pages 93-94 in Working Papers).

On your own, Page 83 (Pages 95-96)... Started, but did not complete.

(Contact Hours = 3.00 Hours. Students = ARM)

March 27, 2023 6:00 PM

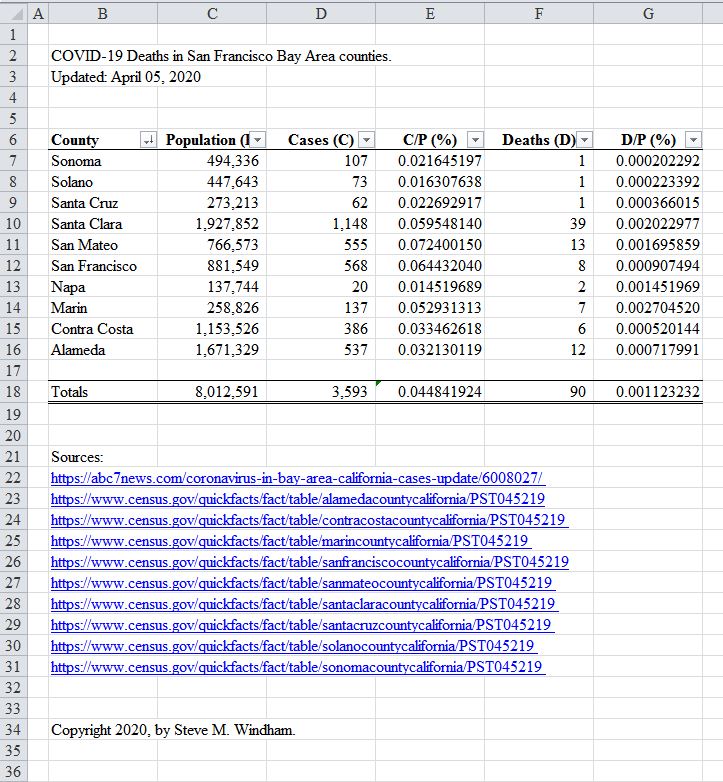

Class cancelled -- Steve had COVID.

April 03, 2023 6:00 PM

Class Cancelled -- Steve had COVID.

April 10, 2023 6:00 PM

Class Cancelled -- Steve had COVID.

April 17, 2023 6:00 PM

Class Cancelled -- Tax Season Deadline on 04/18/2023.

April 24, 2023 6:00 PM

Class Cancelled -- Multiple people unable to attend.

May 01, 2023 6:00 PM

On your own, Page 83 (Pages 95-96). Answer key emailed to students.

Explore Accounting (Page 86).

Ethics in Action (Page 96).

Financial Literacy (Page 104).

Careers in Accounting (Page 105).

Review Lesson 4-1.

Audit your understanding (Page 107).

(Contact Hours = 2.35 Hours. Students = AR)

May 08, 2023 6:00 PM

4-1 Work Together, Page 107 (textbook) and Pages 121-126 (working papers).

DEPT ACCT 05.08.2023 4-1 WORK TOGETHER

(Contact Hours = 2.40 Hours. Students = AR)

May 15, 2023 6:00 PM

Class Cancelled -- Multiple people unable to attend.

May 22, 2023 6:00 PM

Class Cancelled -- Steve unable to attend.

May 29, 2023 6:00 PM

Memorial Day Holiday -- No Class.

June 05, 2023 6:00 PM

Review Lesson 4-2.

Audit your understanding (Page 111).

Work together 4-2 (Kitchen Department -- work together, Bath Department -- work alone).

Skip On your own 4-2.

Review: Why Accounting? Accounting for Engineers (Page 118).

Review: Think Like An Accountant. Allocating Corporate Expenses (Page 119). Discuss Dave Ramsey $150 million timeshare lawsuit.

Review: Explore Accounting. Exception Reports (Page 126).

(Contact Hours = 2.70 Hours. Students = ARM).

June 12, 2023 6:00 PM

Class cancelled by Steve.

June 19, 2023 6:00 PM

Class cancelled by Steve.

June 26, 2023 6:00 PM

Review Lesson 4-3.

Audit your understanding (Page 116).

Work Together 4-3 (Preparing financial statements).

Work Together 4-3; Page 116 -- Answer Key (pdf).

(Contact Hours = 2.33 Hours. Students = AR).

**Class will be held on Thursday, June 29 and Thursday, July 06.**

June 29, 2023 6:00 PM

Review Lesson 4-3 to reinforce concepts.

Review Lesson 4-4.

WHY ACCOUNTING? -- Accounting for Engineers, Page 118.

Summary of the Accounting Cycle, Page 121.

Audit your understanding, Page 122.

Chapter Summary, Page 126.

Work together, Textbook Page 122; Working Papers Page 145.

(Contact Hours = 3.00 Hours. Students = ARM).

July 06, 2023 6:00 PM

Class cancelled.

July 10, 2023 6:00 PM

Class cancelled.

July 18, 2023 6:00 PM

Review APPENDIX: Preparing a Work Sheet, Textbook Pages 132-133.

Start Reinforcement Activity 1, Processing and Reporting Departmentalized Accounting Data, Textbook Pages 135-138; Working Papers Pages 187-219.

(Contact Hours = 2.00 Hours. Students = ARM).

Contact Hours are based on the AICPA and IRS C(P)E 50-minute contact hours. Note: Windham Solutions is not registered as a C(P)E provider with the AICPA or the IRS. Their guidelines are simply used for calculating contact hours.

Please download and import the following iCalendar (.ics) files to your calendar system.

Weekly: https://us06web.zoom.us/meeting/tZYldO2trj0uG9Q6okAHOfDPVu3yuDthlTGI/ics?icsToken=98tyKuGqpjguH9STtBiHRpwQGojCLO_ziCFbjfpsyhDuIgh8ZCfGAPcRK6dbBNDc

Join Zoom Meeting

https://us06web.zoom.us/j/82834506410?pwd=RmcvcXpQbG8wK2xtR1pFdENiWjNUUT09

Meeting ID: 828 3450 6410

Passcode: 685647

One tap mobile

+16694449171,,82834506410#,,,,*685647# US

+17193594580,,82834506410#,,,,*685647# US

Dial by your location

+1 669 444 9171 US

+1 719 359 4580 US

+1 720 707 2699 US (Denver)

+1 253 215 8782 US (Tacoma)

+1 346 248 7799 US (Houston)

+1 646 558 8656 US (New York)

+1 646 931 3860 US

+1 301 715 8592 US (Washington DC)

+1 309 205 3325 US

+1 312 626 6799 US (Chicago)

+1 360 209 5623 US

+1 386 347 5053 US

+1 564 217 2000 US

Meeting ID: 828 3450 6410

Passcode: 685647

Find your local number: https://us06web.zoom.us/u/kjHZpbqF

See you soon!

Steve M. Windham

The Internal Revenue Service, on February 10, 2023, has issued guidance on state tax payments to help taxpayers:

The Internal Revenue Service, on February 10, 2023, has issued guidance on state tax payments to help taxpayers:

Request a replacement Social Security card if you meet

Request a replacement Social Security card if you meet