Category: Accounting

Departmentalized Accounting Class

Hello Everyone,

The Departmentalized Accounting class starts on Tuesday, October 18, 2022 at 6:00 PM. The end time will be at approximately 9:00 PM.

The Zoom information and URL to attend the class is:

Steve Windham is inviting you to a scheduled Zoom meeting.

Topic: Departmentalized Accounting

Time: Oct 18, 2022 06:00 PM Pacific Time (US and Canada)

Every week on Tue, 16 occurrence(s):

Oct 18, 2022 6:00 PM

Orientation.

(Contact Hours = 1.00 Hour. Students = ARM)

Oct 25, 2022 6:00 PM

Cancelled--Students waiting on books.

Nov 01, 2022 6:00 PM

Cancelled--Student sick.

Nov 08, 2022 6:00 PM

Cancelled--Student sick.

Nov 15, 2022 6:00 PM

Cancelled--Steve business trip.

Nov 22, 2022 6:00 PM

Reviewed Lesson 1-1 and 1-2, including: ETHICS IN ACTION--Page 6, FORENSIC ACCOUNTING--Page 10 (Excel File), and GLOBAL AWARENESS--Page 18; Working Papers pages 1, 2, 3, 5, & 6.

(Contact Hours = 3.00 Hours. Students = AR)

Nov 29, 2022 6:00 PM

Working Papers pages 7, 8, 9,10, 11, & 12. Reviewed Lesson 1-3, including: WHY ACCOUNTING--Page 20 and EXPLORE ACCOUNTING--Page 30.

(Contact Hours = 3.00 Hours. Students = ARM)

Dec 06, 2022 6:00 PM

Reviewed remainder of Lesson 1-3. Where's my missing dollar problem; Working Papers pages 13, 14, 15, 16, 17, & 18. Review next week's lesson.

(Contact Hours = 3.00 Hours. Students = ARM)

Dec 13, 2022 6:00 PM

Multiple people sick--class cancelled.

Dec 20, 2022 06:00 PM

Christmas break--no class.

Dec 27, 2022 6:00 PM

Textbook 1-1 Application Problem, Page 31 (Working Papers Page 19), Textbook 1-C Challenge Problem, Page 33 (Working Papers Page 31), Textbook Auditing for Errors, Page 35 (click here for spreadsheet).

(Contact Hours = 2.00 Hours. Students = ARM)

Jan 03, 2023 6:00 PM

Textbook, Pages 36-45. Discuss: Ethics in Action, Page 39 and Financial Literacy, Page 44. Working Papers -- Study Guide 2, Pages 43-45.

(Contact Hours = 3.00 Hours. Students = ARM)

Jan 10, 2023 6:00 PM

Class cancelled -- S sick.

Jan 17, 2023 6:00 PM

Textbook 2-1 Work Together, Page 46 (Working Papers Pages 47-49).

(Contact Hours = 2.00 Hours. Students = RM)

Jan 24, 2023 6:00 PM

Class cancelled -- R in Hawaii.

Jan 31, 2023 6:00 PM

Textbook, finish 2-2, including Chapter Summary, Page 57, Explore Accounting, Transfer Pricing, Page 57, and 21st Century Skills, Page 61.

Textbook 2-1 On Your Own, Page 46 (Working Papers, Pages 50-52).

(Contact Hours = 3.00 Hours. Students = ARM)

February 06, 2023 6:00 PM

Discuss prior week work.

(Contact Hours = 0.75 Hours. Students = ARM)

February 13, 2023 6:00 PM

No class.

February 20, 2023 6:00 PM

Rescheduled for February 21, 2023 6:00PM because Steve was travelling.

February 21, 2023 6:00 PM

Class cancelled -- one of the students was sick.

February 27, 2023 6:00 PM

Review 3-1 (Pages 64-65); Ethics in Action (Page 64); and Global Awareness (Page 65).

Short class due to tax season.

(Contact Hours = 1.00 Hours. Students = ARM)

March 06, 2023 6:00 PM

No class.

March 13, 2023 6:00 PM

Review 3-1 (Pages 66-73); Forensic Accounting (Page 72).

Crazy Eddie Videos on youtube.com.

Audit your understanding (Page 74).

Work Together 3-1, Page 74 (Pages 89-90 in Working Papers).

On Your Own 3-1, Page 74 (Pages 91-92 in Working Papers).

(Contact Hours = 3.00 Hours. Students = ARM)

March 20, 2023 6:00 PM

Review 3-2 (Pages 76-82).

Audit your understanding (Page 83).

Why Accounting? "Executive Compensation" (Page 82).

Audit your understanding (Page 82).

Work together 3-2, Page 83 (Pages 93-94 in Working Papers).

On your own, Page 83 (Pages 95-96)... Started, but did not complete.

(Contact Hours = 3.00 Hours. Students = ARM)

March 27, 2023 6:00 PM

Class cancelled -- Steve had COVID.

April 03, 2023 6:00 PM

Class Cancelled -- Steve had COVID.

April 10, 2023 6:00 PM

Class Cancelled -- Steve had COVID.

April 17, 2023 6:00 PM

Class Cancelled -- Tax Season Deadline on 04/18/2023.

April 24, 2023 6:00 PM

Class Cancelled -- Multiple people unable to attend.

May 01, 2023 6:00 PM

On your own, Page 83 (Pages 95-96). Answer key emailed to students.

Explore Accounting (Page 86).

Ethics in Action (Page 96).

Financial Literacy (Page 104).

Careers in Accounting (Page 105).

Review Lesson 4-1.

Audit your understanding (Page 107).

(Contact Hours = 2.35 Hours. Students = AR)

May 08, 2023 6:00 PM

4-1 Work Together, Page 107 (textbook) and Pages 121-126 (working papers).

DEPT ACCT 05.08.2023 4-1 WORK TOGETHER

(Contact Hours = 2.40 Hours. Students = AR)

May 15, 2023 6:00 PM

Class Cancelled -- Multiple people unable to attend.

May 22, 2023 6:00 PM

Class Cancelled -- Steve unable to attend.

May 29, 2023 6:00 PM

Memorial Day Holiday -- No Class.

June 05, 2023 6:00 PM

Review Lesson 4-2.

Audit your understanding (Page 111).

Work together 4-2 (Kitchen Department -- work together, Bath Department -- work alone).

Skip On your own 4-2.

Review: Why Accounting? Accounting for Engineers (Page 118).

Review: Think Like An Accountant. Allocating Corporate Expenses (Page 119). Discuss Dave Ramsey $150 million timeshare lawsuit.

Review: Explore Accounting. Exception Reports (Page 126).

(Contact Hours = 2.70 Hours. Students = ARM).

June 12, 2023 6:00 PM

Class cancelled by Steve.

June 19, 2023 6:00 PM

Class cancelled by Steve.

June 26, 2023 6:00 PM

Review Lesson 4-3.

Audit your understanding (Page 116).

Work Together 4-3 (Preparing financial statements).

Work Together 4-3; Page 116 -- Answer Key (pdf).

(Contact Hours = 2.33 Hours. Students = AR).

**Class will be held on Thursday, June 29 and Thursday, July 06.**

June 29, 2023 6:00 PM

Review Lesson 4-3 to reinforce concepts.

Review Lesson 4-4.

WHY ACCOUNTING? -- Accounting for Engineers, Page 118.

Summary of the Accounting Cycle, Page 121.

Audit your understanding, Page 122.

Chapter Summary, Page 126.

Work together, Textbook Page 122; Working Papers Page 145.

(Contact Hours = 3.00 Hours. Students = ARM).

July 06, 2023 6:00 PM

Class cancelled.

July 10, 2023 6:00 PM

Class cancelled.

July 18, 2023 6:00 PM

Review APPENDIX: Preparing a Work Sheet, Textbook Pages 132-133.

Start Reinforcement Activity 1, Processing and Reporting Departmentalized Accounting Data, Textbook Pages 135-138; Working Papers Pages 187-219.

(Contact Hours = 2.00 Hours. Students = ARM).

Contact Hours are based on the AICPA and IRS C(P)E 50-minute contact hours. Note: Windham Solutions is not registered as a C(P)E provider with the AICPA or the IRS. Their guidelines are simply used for calculating contact hours.

Please download and import the following iCalendar (.ics) files to your calendar system.

Weekly: https://us06web.zoom.us/meeting/tZYldO2trj0uG9Q6okAHOfDPVu3yuDthlTGI/ics?icsToken=98tyKuGqpjguH9STtBiHRpwQGojCLO_ziCFbjfpsyhDuIgh8ZCfGAPcRK6dbBNDc

Join Zoom Meeting

https://us06web.zoom.us/j/82834506410?pwd=RmcvcXpQbG8wK2xtR1pFdENiWjNUUT09

Meeting ID: 828 3450 6410

Passcode: 685647

One tap mobile

+16694449171,,82834506410#,,,,*685647# US

+17193594580,,82834506410#,,,,*685647# US

Dial by your location

+1 669 444 9171 US

+1 719 359 4580 US

+1 720 707 2699 US (Denver)

+1 253 215 8782 US (Tacoma)

+1 346 248 7799 US (Houston)

+1 646 558 8656 US (New York)

+1 646 931 3860 US

+1 301 715 8592 US (Washington DC)

+1 309 205 3325 US

+1 312 626 6799 US (Chicago)

+1 360 209 5623 US

+1 386 347 5053 US

+1 564 217 2000 US

Meeting ID: 828 3450 6410

Passcode: 685647

Find your local number: https://us06web.zoom.us/u/kjHZpbqF

See you soon!

Steve M. Windham

January 23, 2023 — IRS Official Start Date for the 2023 Tax Filing Season

The Internal Revenue Service has announced that January 23, 2023 will be the official start date of the 2023 tax filing season. This is the first date that the IRS will be processing 2022 tax returns. The deadline this year is April 18, 2023, as per the IRS website:

The Internal Revenue Service has announced that January 23, 2023 will be the official start date of the 2023 tax filing season. This is the first date that the IRS will be processing 2022 tax returns. The deadline this year is April 18, 2023, as per the IRS website:

The filing deadline to submit 2022 tax returns or an extension to file and pay tax owed is Tuesday, April 18, 2023, for most taxpayers. By law, Washington, D.C., holidays impact tax deadlines for everyone in the same way as federal holidays. The due date is April 18, instead of April 15, because of the weekend and the District of Columbia's Emancipation Day holiday, which falls on Monday, April 17.

Taxpayers requesting an extension will have until Monday, October 16, 2023, to file.

This year, taxpayers and tax professionals should see improved service and processing times. This is due to the passage of the Inflation Reduction Act, which has resulted in the IRS hiring more than 5,000 new telephone assistors, as well as more in-person staff to provide support to taxpayers.

Accounting as a STEM Major

Accounting is in the process of becoming a STEM major. Many colleges and universities have certified Accounting as STEM majors. Furthermore, there is Federal legislation that, if passed, will result in Accounting being a STEM subject for K-12. For more info, click on the link below.

Introduced in House (06/11/2021)

Accounting STEM Pursuit Act of 2021

The American Institute of Certified Public Accountants (AICPA) is also very interested in Accounting becoming a STEM subject. Click here to read the AICPA's "NOMINATION OF ACCOUNTING AND RELATED CIP CODES FOR INCLUSION IN DHS STEM DESIGNATED DEGREE PROGRAM LIST."

I have made a video that discusses this and other issues relating to Accounting as a major and profession. The video can be found here.

I now teach at the Vacaville Adult School… again!

Updated on Saturday, March 18, 2023.

This class was cancelled on March 07, 2023, as the administration and I were unable to come to an agreement over several issues. As such, this course has been cancelled and no further class meetings will be held. At present, I am no longer affiliated with the Vacaville Adult School and/or the Muzetta Thrower Adult Education Center. I remain a credentialed educator in good standing with the California Commission on Teacher Credentialing.

If you are interested in taking this course directly through me, please contact me. Tentatively, I will be teaching Accounting I online, in real-time, using Zoom starting sometime around May or June 2023.

My first actual teaching job as teacher of record was at the Vacaville Adult School where I taught High School Diploma Independent Study and Digital Photography. I am back at the Vacaville Adult School teaching Accounting at the Muzetta Thrower Adult Education Center. I am very much looking forward to teaching in Vacaville again! The start date for my course is February 09, 2023.

Here is a link to my current course:

https://go.asapconnected.com/?org=4848#CourseID=280857

I now teach at the University of Idaho!

Commencing in January 2023, I will be teaching Accounting part-time, online at the University of Idaho in the Accounting & MIS Department of the College of Business and Economics. If anyone is looking to obtain a Bachelor in Business Administration degree, the University of Idaho now offers an Online Bachelor of Business Administration Degree, as well as several Online Business Certificates. The College of Business and Economics Online Education page can be found here: https://www.uidaho.edu/cbe/distance-education.

University of Idaho students -- Click here for my teacher page.

If you are a client and are wondering if I am still going to be offering my accounting and tax services, the answer is: Yes! For the most part, everything will be business as usual. The only caveat is that I am doing more work online and meeting less with clients in person. If, however, your situation necessitates that we meet in person, this can be arranged. For more information, please visit: https://windhamsolutions.com/year-end-2022-update/ or call me at: 707-65-3325.

Accounting Certifications & Licenses

Several students have inquired as to what different accounting licenses and certifications are available and what they can do for you professionally. There are several different types of licenses and certifications available to the accounting professional. Certain credentials, such as the PTIN, are required to do certain types of tax work. Other credentials, such as the ERO and FINCen BSA E-Filing Account are required to e-file different types of tax returns. Credentials such as the CTEC, EA, CPA, and a law license are required to legally perform certain types of work. Yet, other credentials, show that the credential holder has a certain degree of knowledge, such as the CMA. This list is not exhaustive, but it is a starting point.

Tax Professional Certifications, Credentials, Licenses, and Other (Federal Level):

- IRS Acceptance Agent and Certified Acceptance Agent -- Required for those who wish to process IRS Forms W-7 for the Individual Tax Identification Numbers.

https://www.irs.gov/individuals/international-taxpayers/acceptance-agent-program

. - IRS Annual Filing Season Program -- Non-credentialed return preparers who aspire to a higher level of professionalism.

https://www.irs.gov/tax-professionals/annual-filing-season-program

. - IRS Centralized Authorization File (CAF) -- Used by the IRS to store Powers of Attorney and other documents that allow the tax practitioner to access taxpayer records.

https://www.irs.gov/businesses/small-businesses-self-employed/the-centralized-authorization-file-caf-authorization-rules

. - IRS Enrolled Agent -- The highest credential awarded by the Internal Revenue Service that grants unlimited practice rights before the Internal Revenue Service.

https://www.irs.gov/tax-professionals/enrolled-agents/enrolled-agent-information

. - IRS Employer Identification Number (EIN) -- Required if you form an entity.

https://www.irs.gov/businesses/small-businesses-self-employed/employer-id-numbers

. - IRS ERO (Electronic Return Originator) -- Required to e-file federal tax returns.

https://www.irs.gov/e-file-providers/become-an-authorized-e-file-provider

. - IRS E-Services Account -- E-Services that are offered only to tax professionals.

https://www.irs.gov/e-services

. - IRS PTIN (Preparer Tax Identification Number) -- Required to sign tax returns and engage in other tax work.

https://www.irs.gov/tax-professionals/ptin-application-checklist-what-you-need-to-get-started

. - US Tax Court (Attorney and Non-Attorney Practitioners) -- For those who wish to represent clients before the United States Tax Court.

https://www.ustaxcourt.gov/practitioners.html

.

- US Treasury Financial Crime Enforcement Network Bank Secrecy Act E-Filing System -- For those who need to file FBARs.

https://bsaefiling.fincen.treas.gov/main.html

Certified Public Accountant (CPA) License

- American Institute of Certified Public Accountants (AICPA)

- National Association of State Boards of Accountancy (NASBA)

. - State Boards of Accountancy and Licensing Boards for CPAs:

- Alabama State Board of Public Accountancy

- Alaska Board of Public Accountancy

- Arizona State Board of Accountancy

- Arkansas State Board of Public Accountancy

- California Board of Accountancy

- Colorado Board of Accountancy

- Connecticut State Board of Accountancy

- Delaware Board of Accountancy

- Florida Division of Certified Public Accounting

- Georgia State Board of Accountancy

- Hawaii Board of Public Accountancy

- Idaho State Board of Accountancy

- Illinois Board of Examiners

- Indiana Professional Licensing Agency

- Iowa Professional Licensing and Regulation Bureau

- Kansas Board of Accountancy

- Kentucky Board of Accountancy

- Louisiana State Board of Certified Public Accountants of Louisiana

- Maine Board of Accountancy

- Maryland Board of Public Accountancy

- Massachusetts Board of Public Accountancy

- Michigan Board of Accountancy

- Minnesota Board of Accountancy

- Mississippi State Board of Public Accountancy

- Missouri Board of Accountancy

- Montana Board of Public Accountants

- Nebraska Board of Public Accountancy

- Nevada State Board of Accountancy

- New Hampshire Board of Accountancy

- New Jersey State Board of Accountancy

- New Mexico Public Accountancy Board (NMPAB)

- New York State Board for Public Accountancy

- North Carolina State Board of Certified Public Accountant Examiners

- North Dakota Board of Accountancy

- Ohio Accountancy Board of Ohio

- Oklahoma Accountancy Board

- Oregon Board of Accountancy

- Pennsylvania State Board of Accountancy

- Rhode Island Board of Accountancy

- South Carolina Board of Accountancy

- South Dakota Board of Accountancy

- Tennessee State Board of Accountancy

- Texas State Board of Public Accountancy

- Utah Division of Occupational and Professional Licensing--Accountancy

- Vermont Board of Public Accountancy

- Virginia Board of Accountancy

- Washington State Board of Accountancy

- West Virginia Board of Accountancy

- Wisconsin Department of Safety and Professional Services

- Wyoming Board of Certified Public Accountants

- Washington, D.C. Department of Licensing and Consumer Protection

- American Samoa Bar Association

- Commonwealth of the Northern Mariana Islands (NASBA)

- Guam Board of Accountancy

- Puerto Rico Departamento de Estado

- U.S. Virgin Islands Board of Public Accountancy

State-Level Tax Preparer Licensing Bodies

- California -- California Tax Education Council (CTEC)

- Connecticut -- Paid Preparers and Facilitators

- Illinois -- Public Act 099-0641

- Maryland -- Board of Individual Tax Preparers

- New York -- Tax Preparer and Facilitator Registration

- Oregon -- Oregon Board of Tax Practitioners

Miscellaneous Accounting and Accounting-Related Certifications

- Certified Bookkeeper -- American Institute of Professional Bookkeepers (AIPB)

- Certified Financial Analyst

- Certified Financial Crime Specialists -- Various Certifications

- Certified Financial Planner

- Certified Fraud Examiner

- Certified Internal Auditor

- Certified Management Accountant & Certified in Strategy and Competitive Analysis

- Certified Treasury Professional

- Chartered Accountant (England & Wales)

- National Association of Certified Public Bookkeepers (NACPB) -- Various Accounting Certifications

Recommended Study Guides

Advanced Accounting — Departmentalized Accounting Course

Advanced Accounting -- Departmentalized Accounting Course

Start Date: Tuesday, October 18, 2022

Frequency: Every Tuesday (except holidays) for approximately three months. Three (3) hour meetings.

Location: Zoom

For more information, please visit:

ADVANCED ACCOUNTING — DEPARTMENTALIZED ACCOUNTING COURSE RESOURCES LIBRARY

Certified Bookkeeper Sequence of Courses

I will be offering a sequence of courses that lead to the American Institute of Professional Bookkeeper's Certified Bookkeeper Designation.

Accounting Systems — Final Stretch

Accounting Systems Students,

Class is cancelled for Wednesday, August 04, 2021, and will resume on Wednesday, August 11, 2021. We should be able to complete this course within the next few weeks. Keep up the good work, we are getting close!

Class meeting information, online via Zoom.

Steve Windham is inviting you to a scheduled Zoom meeting.

Topic: Accounting Systems

Time: 06:00 PM Pacific Time (US and Canada)

Every week on Monday's.

Join Zoom Meeting

https://zoom.us/j/97673985504

Meeting ID: 976 7398 5504

One tap mobile

+16699009128,,97673985504# US (San Jose)

+12532158782,,97673985504# US (Tacoma)

Dial by your location

+1 669 900 9128 US (San Jose)

+1 253 215 8782 US (Tacoma)

+1 346 248 7799 US (Houston)

+1 301 715 8592 US (Germantown)

+1 312 626 6799 US (Chicago)

+1 646 558 8656 US (New York)

Meeting ID: 976 7398 5504

Find your local number: https://zoom.us/u/aeoPMcAQJ4

Topic: Accounting Systems, Week 1

Time: 06:00 PM Pacific Time (US and Canada)

The virtual meeting will open at 5:45PM; class starts at 6:00PM and concludes at 9:00PM.

Study materials and information for the Accounting Systems class can be found below:

*If any of you have difficulties logging in, feel free to call me at: 707-635-3325.

I am looking forward to seeing you soon!

Steve M. Windham

Tax Filing Season opens February 12, 2021

The 2021 tax filing season for Tax Year 2020 does not open until February 12, 2021. As such, I am not meeting with individual clients for tax appointments before February 12, 2021. I am; however, meeting with corporate clients, bookkeeping clients, and other business clients now so that we can finalize whatever is necessary to complete and file your business tax returns on time. Should you have any questions, please contact me. Thank you!

Accounting III — November 03, 2020 & End of Class Dinner Party on Wednesday, November 11, 2020.

Accounting III Students,

Class meeting information for November 03, 2020 at 6:00PM, online via Zoom.

Tonight is the Final Examination!

Wednesday November 11, 2020 at 6PM, we will have an end-of-class dinner party.

Restaurant: 3

Location: 721 Texas Street, Fairfield, CA 94533

URL: https://threefoodbeerwine.com/

Steve Windham is inviting you to a scheduled Zoom meeting.

Topic: Accounting III, Week 21

Time: October 27, 2020 06:00 PM Pacific Time (US and Canada)

Please use the link below to login:

Meeting ID: 969 2849 4410

One tap mobile

+16699009128,,96928494410# US (San Jose)

+12532158782,,96928494410# US (Tacoma)

Dial by your location

+1 669 900 9128 US (San Jose)

+1 253 215 8782 US (Tacoma)

+1 346 248 7799 US (Houston)

+1 312 626 6799 US (Chicago)

+1 646 558 8656 US (New York)

+1 301 715 8592 US (Germantown)

Meeting ID: 969 2849 4410

Find your local number: https://zoom.us/u/abPzuQd5JY

The virtual meeting will open at 5:45PM; class starts at 6:00PM and concludes at 9:00PM. The first few weeks will be spent making sure that everyone is able to login and access the course, as well as a review of Accounting I and Accounting II.

Study materials and information for the Accounting III class can be found below:

*If any of you have difficulties logging in, feel free to call me at: 707-635-3325.

I am looking forward to seeing you soon!

Announcement To My Fairfield-Suisun Adult School Accounting Students

Steve M. Windham

Enrolled Agent Study Materials

An Enrolled Agent is a credential awarded by the US Treasury/Internal Revenue Service that allows the credential holder to represent taxpayers before the Internal Revenue Service. The Enrolled Agent credential is the highest credential that the Internal Revenue Service Awards. For more information about the Enrolled Agent credential, please click here: https://www.irs.gov/tax-professionals/enrolled-agents

I strongly urge all of my accounting students to obtain their Enrolled Agent credentials. While the exam is rigorous, it is manageable. The exam is divided into three parts: 1) Individuals, 2) Businesses, and 3) Representation, Practices and Procedure. Section 2--Businesses, is by far the most difficult section.

My recommendation is to use the Gleim Enrolled Agent Review Course. This is the study course that I used for my Enrolled Agent exam, and I also plan to use Gleim for the CPA and CMA exams. Here is a link to the Gleim Enrolled Agent Review Courses: https://www.gleim.com/enrolled-agent-review/courses/

My recommendation is to purchase either the Traditional or Premium review systems.

.

.

Accounting Systems Course (Revised 08/26/2020)

Hello Students!

I will be teaching an online real-time (synchronous) course on Accounting Systems. Please see the link below for more information.

Accounting III Start Date

Hello Everyone,

The start date for Accounting III will be Tuesday, June 09, 2020. The run time will be from 6:00PM to 9:00PM. We will meet once per week for approximately 12 to 15 weeks.

Initially, the first few meeting will be held online using Zoom. When things open up from the Coronavirus, we will move the meeting to in-person at my home in Vacaville.

Note that the first few meetings will be used to review Accounting I and II concepts, and to address technology issues, books and working papers issues, et cetera.

Please feel free to contact me if you have any questions.

Please review these posts for more information:

Announcement To My Fairfield-Suisun Adult School Accounting Students

Accounting III Update

Dear Students,

In light of the current COVID-19 crisis, it is highly likely that the Accounting III class will be postponed. Because this is a fluid situation, it may be best not to commit to a start date just yet.

The alternative is to maintain the start date (the week of April 19, 2020), but to conduct the class online. This would be a live class, conducted using Google Hangouts. From speaking with many of you, it seems that the majority of you prefer in-person delivery. A possibility is that we could start the class with online delivery, and then move to in-person delivery when people feel comfortable doing so.

I would greatly appreciate your input, so please get in touch with me and let me know your preferences. In the meantime, stay safe!

Thank you!

Steve M. Windham

Tel/Text: 707.635.3325

Email: [email protected]

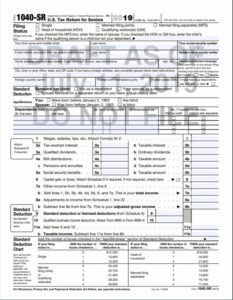

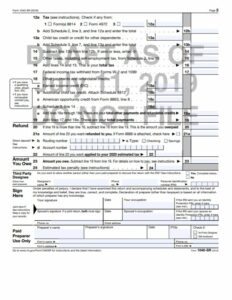

Introducing the IRS Form 1040-SR, U.S. Tax Return for Seniors

For tax year 2018, the Internal Revenue Service introduced the "postcard" 1040, along with six new schedules (to make up for chopping the Form 1040 in half). Forms 1040-A and 1040-EZ were also eliminated.

For tax year 2019, the Internal Revenue Service is introducing the Form 1040-SR, U.S. Tax Return for Seniors.

Interestingly, the old Form 1040 was largely able to accommodate everything the 1040-A, 1040-EZ, the new "postcard" 1040, and the 1040-SR could accommodate without the six additional schedules.

So while these curious new forms are somewhat interesting, they have done little, if anything, to streamline tax filing. This seems to be another case of the government fixing something that is not broken, as the Form 1040 was a finely-honed and efficient form that did an exemplary job of reporting individual income to the Internal Revenue Service.

My Resignation from the Fairfield-Suisun Adult School

Dear Students and Colleagues,

On Friday, February 15, 2019, I resigned my teaching position at the Fairfield-Suisun Adult School. My resignation was accepted by the Fairfield-Suisun Unified School District on Thursday, February 21, 2019. Without going into details, I will say that this was not a decision that I took lightly. I will miss working with my amazing students and colleagues. I plan on teaching accounting and financial crimes at another school in the not too-distant future. For those trying to access my teacher page, it has been disabled by the administrators. I have migrated some of the information from my teacher page to this website.

Steve M. Windham

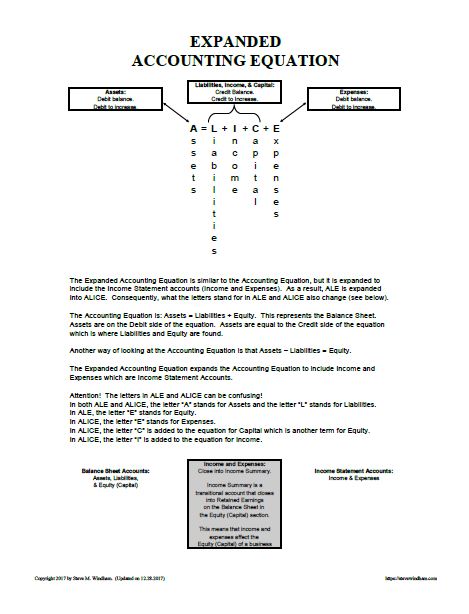

The Accounting Equation (ALE) and Expanded Accounting Equation (ALICE) Explained

Understanding the Accounting Equation (ALE) and the Expanded Accounting Equation (ALICE) is critical to your success in accounting. The image below is downloadable as a PDF (see link at bottom of post).

Accounting & Taxation Resources

I have added a new section to this website that includes several useful Accounting and Taxation links. Please visit my Accounting and Taxation Resource Library.

Link: LIBRARY

Average CPA Salary is Now Over $100,000

See the Journal of Accountancy article on CPA salaries:

https://www.journalofaccountancy.com/news/2017/sep/cpa-average-salary-201717483.html

Recent Changes in the California CPA Exam Educational Requirements

As of January 01, 2017, the California Board of Accountancy implemented additional educational requirements to sit for the California CPA exam. The California Board of Accountancy now requires:

1) A baccaleaureate degreefrom an accredited college or university (any subject),

2) 150 semester hours of total college/university study,

3) 24 semester units of accounting study,

4) 24 semester units of business-related subjects study,

5) 20 semester units of accounting study,

6) 10 semester units of ethics study, to include one 3 unit semester (or 4 unit quarter) course in accounting ethics or accountant's professional responsibility.

The above-listed educational requirements are in addition to verified work experience where the CPA exam applicant must have documented work experience under a licensed CPA. See the California CPA Applicant Licensing Handbook for more information about the experience requirement.

![]()

California CPA Licensure Tip Sheet

California Board of Accountancy Educational Requirements![]()

![]() California CPA Applicant Licensing Handbook

California CPA Applicant Licensing Handbook